Accacia offers an AI-enabled SAAS platform that helps real estate asset managers, owners and developers track their emissions

April 23, 2024 | Staff Reporter | Global | Facilities Management

Accacia, a decarbonisation platform focusing on the real estate and infrastructure sectors, has closed a US$6.5m pre-Series A round led by Illuminate Financial – a specialist VC firm focused on enterprise fintech companies building solutions for the financial services industry with offices in New York, London and Singapore. Southeast Asia based AC Ventures also participated in this round, alongside continued support from early backers Accel and B Capital.

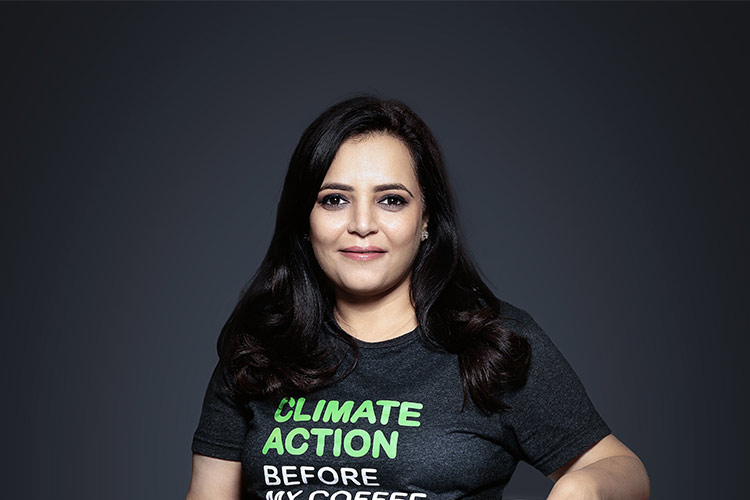

Real estate and construction activity contribute to about 40% of global Greenhouse Gas (GHG) emissions. The sector lacks robust tools to measure climate risks and define decarbonisation pathways. Founded in 2022 by INSEAD alumni Annu Talreja and co-founders Piyush Chitkara and Jagmohan Garg, Accacia offers an AI-enabled SAAS platform that helps real estate asset managers, owners and developers track their emissions, and design their decarbonisation journey.

“This funding comes at a crucial juncture as the Securities & Exchange Commission (SEC) and Singapore Exchange (SGX) have announced regulations on carbon emissions reporting, underscoring the urgent need for comprehensive and real-time climate risk data. We have already deployed our solution to over 25m sq ft of real estate and are poised to leverage this opportunity and scale globally,” said Annu Talreja, Founder and CEO at Accacia.

Illuminate Financial, with its extensive network of financial services’ industry LPs, has a unique perspective of this evolution where climate risk is becoming a must-have metric for investors. “Measuring and managing climate risks has become imperative for large financial institutions especially in real estate which is one of the most significant and most affected asset classes in their portfolio. With Annu’s background and industry experience in real estate, we felt Accacia is the right fit to take on a leading position in the global real estate decarbonization market and are pleased to partner with the Accacia team,” said Rezso Szabo, Partner at Illuminate Financial.

While real estate is one of the single largest contributors to GHG emissions, it is also a very hard-to-decarbonize sector given the complexity of value chain emissions (construction vs operations) and the variety of asset uses. Given our deep interest in climate, we were confident that the sector demanded a custom solution designed for nuances of the real estate sector and loved what Accacia has built.

Helen Wong, Managing Partner at AC Ventures

“While real estate is one of the single largest contributors to GHG emissions, it is also a very hard-to-decarbonize sector given the complexity of value chain emissions (construction vs operations) and the variety of asset uses. Given our deep interest in climate, we were confident that the sector demanded a custom solution designed for nuances of the real estate sector and loved what Accacia has built,” said Helen Wong, Managing Partner at AC Ventures.

Decarbonisation of real estate is one the biggest opportunities today – a staggering US$18 trillion of investment is required over the next decade to get the real estate industry to net zero. Accacia’s tech platform integrates with existing property management, energy management and procurement systems to automate real-time data capturing and tracking, making it the quickest and most affordable solution for real estate companies on their path to net zero. The real estate industry has recently become the focus for climate solutions with several large VC funds raising dedicated capital to decarbonise buildings.